Report

Online Fashion Retail Market In India 2025-2029

India Online Fashion Retail Market Outlook (2025–2029)

The India online fashion retail market is projected to grow by USD 35.01 billion, expanding at a compound annual growth rate (CAGR) of 22.1% between 2024 and 2029. This growth is driven by rapid digital adoption, rising internet and smartphone penetration, and evolving consumer behavior.

Market Overview

The market is experiencing significant transformation due to the expansion of the digital economy. Increased smartphone usage, widespread internet availability, and a growing social media user base are fostering greater engagement between brands and consumers. This digital engagement is creating new opportunities for online fashion retailers to scale operations and enhance brand visibility.

However, challenges persist—particularly around payment infrastructure. A sizable portion of the Indian population remains unbanked or underbanked, limiting access to digital transactions and affecting online purchasing behavior.

Key Market Drivers

- Expanding Internet and Smartphone Penetration

Internet users in India grew from 795 million (2020) to over 936 million (2023). Affordable smartphones and improved connectivity have broadened access to e-commerce platforms across urban and semi-urban regions. - Shift Toward Online Convenience

Time-constrained lifestyles are encouraging consumers to adopt online shopping for wardrobe essentials, driven by convenience and an increasingly digital-savvy population. - Rising Disposable Income and Urbanization

As urbanization accelerates and disposable income increases, more consumers are willing to spend on fashion, fueling market expansion.

Emerging Trends

- Social Commerce and Brand Engagement via Social Media

Platforms like Instagram, Facebook, YouTube, and Pinterest are transforming into sales channels, enabling direct purchases from brand feeds. This integration of commerce and social interaction is reshaping consumer behavior and marketing strategies. - Growth of Ethical and Sustainable Fashion

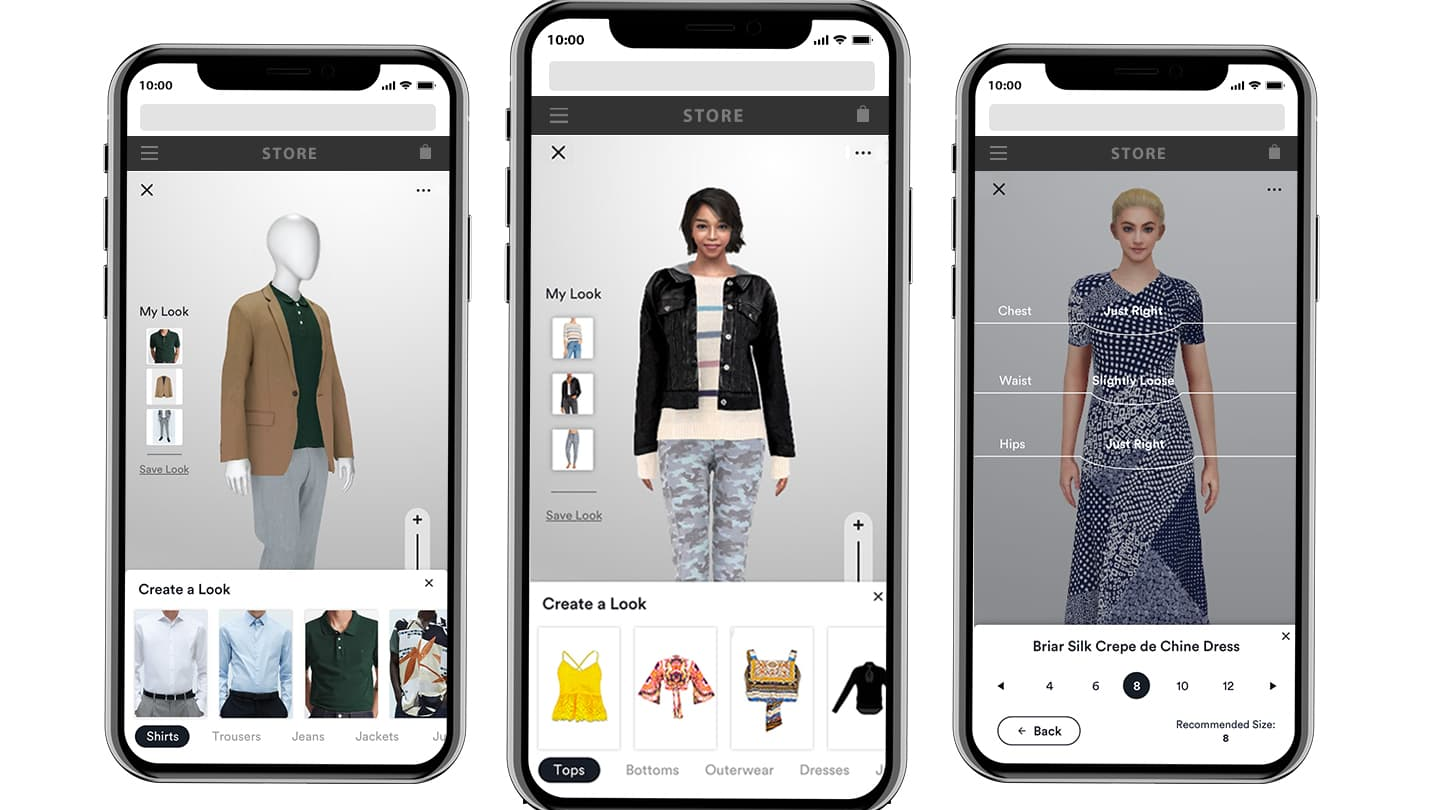

Consumers are increasingly inclined toward organic cotton, eco-friendly products, and sustainable sourcing. This shift is influencing product development and positioning strategies among retailers. - Omnichannel Retailing

Blending online and offline experiences remains a key strategy. Leading fashion brands are focusing on integrated customer journeys through physical stores, apps, and web platforms.

Challenges Impacting Market Growth

- Payment Infrastructure and Digital Divide

Despite improvements in digital payments, many consumers—especially in rural areas—lack access to online banking. Cash remains a dominant mode of transaction. Moreover, more than 25,000 villages in India still lack mobile or internet connectivity. - Consumer Trust and Cybersecurity Concerns

Concerns around payment security and data privacy continue to act as barriers to online transactions, requiring stronger digital trust-building measures.

Strategic Recommendations

To capitalize on growth opportunities and navigate structural challenges, companies should:

- Invest in robust digital payment solutions tailored to semi-urban and rural consumers.

- Expand partnerships with local logistics and retail players to optimize last-mile delivery.

- Enhance the user experience across digital platforms, with personalization and customer service as key differentiators.

- Incorporate sustainability and ethical sourcing into brand value propositions to align with evolving consumer values.

Key Market Participants

Several global and domestic players are actively shaping the competitive landscape through strategic alliances, geographic expansion, product innovation, and mergers. Notable companies include:

- A M Marketplaces Pvt. Ltd.

- Adidas AG

- Aditya Birla Management Corp. Pvt. Ltd.

- Alibaba Group Holding Ltd.

- Amazon.com Inc.

- Benetton Group Srl

- Dolce and Gabbana S.r.l.

- eBay Inc.

- Gildan Activewear Inc.

- H&M Hennes and Mauritz GBC AB

- Levi Strauss and Co.

- Naaptol Online Shopping Pvt. Ltd.

- Reliance Industries Ltd.

- Snapdeal Ltd.

- Tata Sons Pvt. Ltd.

- Walmart Inc.

These companies are categorized based on qualitative and quantitative criteria, including market dominance, specialization, and innovation focus. This segmentation helps stakeholders assess competitive positioning and partnership potential.

Conclusion

The India online fashion retail market offers robust long-term growth potential, supported by favorable digital and demographic trends. However, realizing this potential requires addressing infrastructural and trust-related challenges. Companies that adapt with localized strategies, digital innovation, and sustainability commitments will be well-positioned to lead in this evolving landscape.

TABLE OF CONTENTS

1 Executive Summary

1.1 Market overview

- Executive Summary - Chart on Market Overview

- Executive Summary - Data Table on Market Overview

- Executive Summary - Chart on Country Market Characteristics

- Executive Summary - Chart on Market Segmentation by Product

- Executive Summary - Chart on Market Segmentation by Gender

- Executive Summary - Chart on Company Market Positioning

2 Market Landscape

2.1 Market ecosystem

- Parent Market

- Data Table on - Parent Market

2.2 Market characteristics

- Market characteristics analysis

2.3 Value chain analysis

- Value Chain Analysis

3 Market Sizing

3.1 Market definition

- Offerings of companies included in the market definition

3.2 Market segment analysis

- Market segments

3.3 Market size 2025

3.4 Market outlook: Forecast for 2025-2029

- Chart on India - Market size and forecast 2025-2029 ($ million)

- Data Table on India - Market size and forecast 2025-2029 ($ million)

- Chart on India: Year-over-year growth 2025-2029 (%)

- Data Table on India: Year-over-year growth 2025-2029 (%)

4 Historic Market Size

4.1 Online Fashion Retail Market in India 2022 - 2024

- Historic Market Size - Data Table on Online Fashion Retail Market in India 2022 - 2024 ($ million)

4.2 Product segment analysis 2022 - 2024

- Historic Market Size - Product Segment 2022 - 2024 ($ million)

4.3 Gender segment analysis 2022 - 2024

- Historic Market Size - Gender Segment 2022 - 2024 ($ million)

5 Five Forces Analysis

5.1 Five forces summary

- Five forces analysis - Comparison between 2025 and 2029

5.2 Bargaining power of buyers

- Bargaining power of buyers - Impact of key factors 2025 and 2029

5.3 Bargaining power of suppliers

- Bargaining power of suppliers - Impact of key factors in 2025 and 2029

5.4 Threat of new entrants

- Threat of new entrants - Impact of key factors in 2025 and 2029

5.5 Threat of substitutes

- Threat of substitutes - Impact of key factors in 2025 and 2029

5.6 Threat of rivalry

- Threat of rivalry - Impact of key factors in 2025 and 2029

5.7 Market condition

- Chart on Market condition - Five forces 2025 and 2029

6 Market Segmentation by Product

6.1 Market segments

- Chart on Product - Market share 2025-2029 (%)

- Data Table on Product - Market share 2025-2029 (%)

6.2 Comparison by Product

- Chart on Comparison by Product

- Data Table on Comparison by Product

6.3 Apparel - Market size and forecast 2025-2029

- Chart on Apparel - Market size and forecast 2025-2029 ($ million)

- Data Table on Apparel - Market size and forecast 2025-2029 ($ million)

- Chart on Apparel - Year-over-year growth 2025-2029 (%)

- Data Table on Apparel - Year-over-year growth 2025-2029 (%)

6.4 Footwear - Market size and forecast 2025-2029

- Chart on Footwear - Market size and forecast 2025-2029 ($ million)

- Data Table on Footwear - Market size and forecast 2025-2029 ($ million)

- Chart on Footwear - Year-over-year growth 2025-2029 (%)

- Data Table on Footwear - Year-over-year growth 2025-2029 (%)

6.5 Bags and accessories - Market size and forecast 2025-2029

- Chart on Bags and accessories - Market size and forecast 2025-2029 ($ million)

- Data Table on Bags and accessories - Market size and forecast 2025-2029 ($ million)

- Chart on Bags and accessories - Year-over-year growth 2025-2029 (%)

- Data Table on Bags and accessories - Year-over-year growth 2025-2029 (%)

6.6 Market opportunity by Product

- Market opportunity by Product ($ million)

- Data Table on Market opportunity by Product ($ million)

7 Market Segmentation by Gender

7.1 Market segments

- Chart on Gender - Market share 2025-2029 (%)

- Data Table on Gender - Market share 2025-2029 (%)

7.2 Comparison by Gender

- Chart on Comparison by Gender

- Data Table on Comparison by Gender

7.3 Women - Market size and forecast 2025-2029

- Chart on Women - Market size and forecast 2025-2029 ($ million)

- Data Table on Women - Market size and forecast 2025-2029 ($ million)

- Chart on Women - Year-over-year growth 2025-2029 (%)

- Data Table on Women - Year-over-year growth 2025-2029 (%)

7.4 Men - Market size and forecast 2025-2029

- Chart on Men - Market size and forecast 2025-2029 ($ million)

- Data Table on Men - Market size and forecast 2025-2029 ($ million)

- Chart on Men - Year-over-year growth 2025-2029 (%)

- Data Table on Men - Year-over-year growth 2025-2029 (%)

7.5 Children - Market size and forecast 2025-2029

- Chart on Children - Market size and forecast 2025-2029 ($ million)

- Data Table on Children - Market size and forecast 2025-2029 ($ million)

- Chart on Children - Year-over-year growth 2025-2029 (%)

- Data Table on Children - Year-over-year growth 2025-2029 (%)

7.6 Market opportunity by Gender

- Market opportunity by Gender ($ million)

- Data Table on Market opportunity by Gender ($ million)

8 Customer Landscape

8.1 Customer landscape overview

- Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

9 Drivers, Challenges, and Opportunity/Restraints

9.1 Market drivers

9.2 Market challenges

9.3 Impact of drivers and challenges

- Impact of drivers and challenges in 2025 and 2029

9.4 Market opportunities/restraints

10 Competitive Landscape

10.1 Overview

10.2 Competitive Landscape

- Overview on criticality of inputs and factors of differentiation

10.3 Landscape disruption

- Overview on factors of disruption

10.4 Industry risks

- Impact of key risks on business

11 Competitive Analysis

11.1 Companies profiled

- Companies covered

11.2 Market positioning of companies

- Matrix on companies position and classification

11.3 Adidas AG

- Adidas AG - Overview

- Adidas AG - Business segments

- Adidas AG - Key news

- Adidas AG - Key offerings

- Adidas AG - Segment focus

11.4 Aditya Birla Management Corp. Pvt. Ltd

- Aditya Birla Management Corp. Pvt. Ltd. - Overview

- Aditya Birla Management Corp. Pvt. Ltd. - Product / Service

- Aditya Birla Management Corp. Pvt. Ltd. - Key news

- Aditya Birla Management Corp. Pvt. Ltd. - Key offerings

11.5 Alibaba Group Holding Ltd.

- Alibaba Group Holding Ltd. - Overview

- Alibaba Group Holding Ltd. - Business segments

- Alibaba Group Holding Ltd. - Key news

- Alibaba Group Holding Ltd. - Key offerings

- Alibaba Group Holding Ltd. - Segment focus

11.6 Amazon.com Inc.

- com Inc. - Overview

- com Inc. - Business segments

- com Inc. - Key news

- com Inc. - Key offerings

- com Inc. - Segment focus

11.7 Benetton Group Srl

- Benetton Group Srl - Overview

- Benetton Group Srl - Product / Service

- Benetton Group Srl - Key offerings

11.8 eBay Inc.

- eBay Inc. - Overview

- eBay Inc. - Product / Service

- eBay Inc. - Key offerings

11.9 Gildan Activewear SRL

- Gildan Activewear SRL - Overview

- Gildan Activewear SRL - Product / Service

- Gildan Activewear SRL - Key offerings

11.10 GioTech

- GioTech - Overview

- GioTech - Product / Service

- GioTech - Key offerings

11.11 Levi Strauss and Co.

- Levi Strauss and Co. - Overview

- Levi Strauss and Co. - Business segments

- Levi Strauss and Co. - Key news

- Levi Strauss and Co. - Key offerings

- Levi Strauss and Co. - Segment focus

11.12 Reliance Industries Ltd.

- Reliance Industries Ltd. - Overview

- Reliance Industries Ltd. - Business segments

- Reliance Industries Ltd. - Key news

- Reliance Industries Ltd. - Key offerings

- Reliance Industries Ltd. - Segment focus

11.13 Snapdeal Ltd

- Snapdeal Ltd. - Overview

- Snapdeal Ltd. - Product / Service

- Snapdeal Ltd. - Key offerings

11.14 Tata Sons Pvt. Ltd.

- Tata Sons Pvt. Ltd. - Overview

- Tata Sons Pvt. Ltd. - Product / Service

- Tata Sons Pvt. Ltd. - Key news

- Tata Sons Pvt. Ltd. - Key offerings

11.15 The Gap Inc.

- The Gap Inc. - Overview

- The Gap Inc. - Business segments

- The Gap Inc. - Key news

- The Gap Inc. - Key offerings

- The Gap Inc. - Segment focus

11.16 V Mart Retail Ltd

- V Mart Retail Ltd. - Overview

- V Mart Retail Ltd. - Business segments

- V Mart Retail Ltd. - Key offerings

- V Mart Retail Ltd. - Segment focus

11.17 Walmart Inc.

- Walmart Inc. - Overview

- Walmart Inc. - Business segments

- Walmart Inc. - Key news

- Walmart Inc. - Key offerings

- Walmart Inc. - Segment focus

Research Methodology

All our research reports employ a mixed-methods approach, leveraging both primary and secondary research techniques to develop a comprehensive and well-informed analysis. The methodology ensures a balanced perspective by combining data-driven insights with expert opinions.

1. Secondary Research

Secondary research formed the foundation of the study, offering a contextual understanding of the market landscape, historical trends, and existing data. This phase involved gathering and analyzing information from:

- Industry reports and whitepapers (e.g., McKinsey, Deloitte, Statista)

- Academic journals and case studies

- Company reports, investor presentations, and press releases

- Government databases and regulatory publications

- Trade publications, industry blogs, and news articles

2. Primary Research

To validate and complement secondary findings, extensive primary research was conducted. This included both quantitative data collection and qualitative insights, particularly through expert consultations.

a. Expert Consultations (Qualitative Primary Research)

In-depth interviews were conducted with a wide range of industry stakeholders, including:

- Industry experts and consultants

- Senior executives and decision-makers

- Product managers and supply chain professionals

- Academic researchers and analysts

b. Surveys and Questionnaires (Quantitative Primary Research)

Structured surveys were distributed among:

- End-users/consumers

- Retailers and distributors

- Business-to-business (B2B) buyers

3. Data Validation and Triangulation

Findings from secondary and primary sources were cross-validated through data triangulation to ensure accuracy, consistency, and reliability. This process involved comparing insights from different sources and reconciling discrepancies through expert feedback.

4. Analytical Tools and Frameworks

Various analytical models were applied to interpret the collected data:

- SWOT Analysis for understanding strengths, weaknesses, opportunities, and threats

- Porter’s Five Forces to assess market competitiveness

- PESTLE Analysis to evaluate external macroeconomic influences

- Forecasting Models using historical data trends and regression analysis

Conclusion

The combination of comprehensive secondary research and robust primary data collection—enhanced by expert consultations—ensured the development of a well-rounded and in-depth analysis. This approach enables strategic decision-making backed by both empirical evidence and industry expertise.

For detailed methodology for this particular report please write to us on info@syovi.com